Announce plans to launch the first, secure mobile payment solution of

its kind to Canadians

TORONTO, May 15, 2012 /CNW/ – CIBC and Rogers Communications today

announced an agreement to launch Canada’s first joint mobile payment

solution, allowing Canadians to pay with their CIBC credit card at the

checkout counter using their Rogers “Near Field Communications” (NFC)

enabled smartphone. Beginning later this year, customers will be able

to use this payment capability at merchants across Canada where

contactless credit card payments are accepted.

This announcement represents the first time a bank and a wireless

carrier have joined forces to offer a commercially available mobile

payments solution to Canadians that leverages the secure SIM card

inside an NFC-enabled Rogers smartphone. This new solution aligns to

guidelines announced yesterday by the Canadian Bankers Association for

mobile payments in Canada, as well as those developed by respected

international associations such as the GSM Association (GSMA), the

association of mobile operators and related companies dedicated to

standardizing and supporting GSM technology.

“As the leader in delivering mobile financial services innovations in

Canada, we are pleased to introduce yet another innovation in the

market that will shape the payments experience of the future,”

commented David Williamson, Senior Executive Vice President, Retail and

Business Banking, CIBC. “By teaming with Rogers, CIBC clients will soon

enjoy the convenience of paying at the checkout with their mobile

device while enjoying the existing benefits of their CIBC credit card,

including loyalty rewards.”

“Canadians are embracing new technologies at an accelerated pace and we

know they’re interested in using their smartphone for mobile payments,”

said Rob Bruce, President of Communications, Rogers Communications.

“We’ve been laying the foundation for mobile commerce and the ecosystem

is ready to give Canadians the convenience, security, and peace of mind

they deserve,” said Bruce. “Today’s announcement with CIBC represents

an important first step toward a whole new world of mobile transactions

which is a key growth area for the company.”

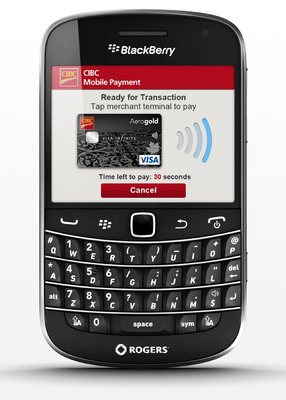

Some of the key features of the new mobile payments solution include:

-

Full access to a client’s existing CIBC credit cards on their smartphone

at no extra cost – whether Visa or MasterCard – this gives clients the

opportunity to earn loyalty points on purchases as they do today. -

Multiple layers of security – Paying with your NFC-enabled smartphone

will be as secure as using your credit card today. Clients will receive

the same fraud protection they do with their contactless credit card,

and secure encryption technology will add to the layers of security

already in place on credit card purchases. Clients will also have the

option to set additional password protection. -

No “stickers” on your phone – this new payment capability will leverage

the secure SIM card inside a mobile device for payments, meaning

clients can manage their credit card credentials on a secure platform,

and won’t need to worry about stickers attached to their phone.

This new CIBC mobile payments capability will be available on select

BlackBerry® smartphones on the Rogers wireless network when the

solution launches later this year, with additional device choices for

clients available following launch.

MasterCard’s Mobile Payments Readiness Index ranks Canada ahead of the

United States and second out of 34 countries. A key finding emphasizes

that partnerships among the key players in the mobile payments

ecosystem – financial institutions, payment networks, telcos,

governments, technology providers – are essential to accelerate the

commercialization of mobile payments.

Today’s announcement builds on CIBC’s leadership position in delivering

mobile innovations to clients. CIBC was the first bank in Canada to

launch a mobile banking App in 2010, and more recently became the first

bank in Canada to deliver an App that allows clients to trade stocks on

their mobile device through the CIBC Mobile Brokerage App. The bank

also offers the CIBC Home Advisor App, free to all Canadian homebuyers,

giving them access to information about housing prices and other key

neighbourhood data in an area they may be considering. CIBC was named

“Best in Mobile Banking” globally by Global Finance magazine in 2011.

In 2002, Rogers launched its GSM wireless network, and last year was the

first carrier in Canada to launch LTE, bringing the largest and fastest

network and a global wireless standard to Canada. Today’s announcement

builds on this foundation of world-class networks, Rogers history of

innovation and mobile commerce expertise, specifically in the area of

mobile proximity payments. Over the past six years, Rogers has worked

with the GSM Association, including the “Pay-buy-Mobile” initiative to

get industry standard payment cards – like MasterCard or Visa – on

industry standard GSM devices. In the past year, the GSM Association

further named Rogers as one of many operators worldwide committed to

SIM-based NFC solutions and services.

“The GSMA congratulate CIBC and Rogers on the launch of their mobile NFC

services and we look forward to many more markets following Canada’s

lead in bringing exciting and interoperable NFC services to life,” said

Anne Bouverot, Director General, GSMA. “This is the year when mobile

NFC is set to take off and the GSMA will continue to support our

members around the world who will be launching their mobile NFC

services later this year.”

CIBC (CM: TSX;NYSE) is a leading North American financial institution

with nearly 11 million personal banking and business clients. CIBC

offers a full range of products and services through its comprehensive

electronic banking network, branches and offices across Canada, and has

offices in the United States and around the world. You can find other

news releases and information about CIBC in our Press Centre on our

corporate website at www.cibc.com.

Rogers Communications is a diversified Canadian communications and media

company. We are engaged in wireless voice and data communications

services through Wireless, Canada’s largest wireless provider. Through

Cable, we are one of Canada’s leading providers of cable television

services as well as high-speed Internet access and telephony services.

Through Media, we are engaged in radio and television broadcasting,

televised shopping, magazines and trade publications, and sports

entertainment. We are publicly traded on the Toronto Stock Exchange

(TSX: RCI.A and RCI.B) and on the New York Stock Exchange (NYSE: RCI).

For further information about the Rogers group of companies, please

visit www.rogers.com.

The BlackBerry and RIM families of related marks, images and symbols are

the exclusive properties and trademarks of Research In Motion Limited

Image with caption: “CIBC and Rogers Unveil the Future of Mobile Payments in Canada – David Williamson, Senior Executive Vice President and Group Head, Retail & Business Banking, CIBC and Rob Bruce, President of Communications, Rogers Communications showcase the first mobile payment solution, allowing Canadians to pay with their CIBC credit card at the checkout counter using their Rogers smartphone. (CNW Group/CIBC)”. Image available at: http://photos.newswire.ca/images/download/20120515_C7740_PHOTO_EN_13750.jpg

Image with caption: “CIBC and Rogers Unveil the Future of Mobile Payments in Canada (CNW Group/CIBC)”. Image available at: http://photos.newswire.ca/images/download/20120515_C7740_PHOTO_EN_13731.jpg

Image with caption: “CIBC and Rogers Unveil the Future of Mobile Payments in Canada (CNW Group/CIBC)”. Image available at: http://photos.newswire.ca/images/download/20120515_C7740_PHOTO_EN_13733.jpg