Canadian wireless prices are declining – the facts nobody is telling you

Rogers is launching a policy and regulatory blog to deepen the understanding of key issues in our sector and contribute to the national conversation about the important role of connectivity in Canada’s long-term success.

We’re kicking things off with a topic that appears to be evergreen in Canada – wireless pricing.

Between quarterly and annual wireless pricing studies, the CRTC’s (the industry regulator) ongoing Mobile Wireless Service Review proceeding, and the federal government’s recent launch of quarterly tracking reports that measure the prices of select plans, the debate around the cost of wireless service in Canada seems to be always be in the news.

Most coverage of this issue is missing key facts and provides an inaccurate view of the situation, suggesting that the price of wireless service in Canada, especially data, remains high and unchanging. In fact, the opposite is true. Wireless prices are declining, and consumers are receiving better value.

Prices are declining as usage increases – both factors must be considered

We track the price our customers pay per GB of data across all our wireless brands – Rogers, Fido and chatr – by dividing data revenue[1] by data traffic on our network[2]. This simple calculation indicates that the relative price of data – the cost per GB – has declined over 50% in the last five years and nearly 70% since 2013.

Monitoring per unit cost accounts for both price and usage, something pricing studies rarely take into consideration. Without looking at both, you get an incomplete picture. For example, if a customer is paying $50 for a 4 GB plan one year, and the next year the plan offers 6 GB of data for $50, the consumer is paying less per GB and receiving more value for money.

We know customers want and are using more data. A year after introducing Rogers Infinite unlimited plans with no overage fees, we had over 1.9 million subscribers (as of the end of June 2020) and in the first half of this year, this base of subscribers grew 36%.[3] (Incidentally, when we introduced Rogers Infinite unlimited plans in June 2019, the sticker price of 10GB plans dropped 25% overnight.)

Meanwhile, an increase in usage has necessitated an increase in capital investment to enable that data growth. The price per GB metric more accurately reflects the underlying benefit the customer receives.

Government data shows prices across the industry are declining

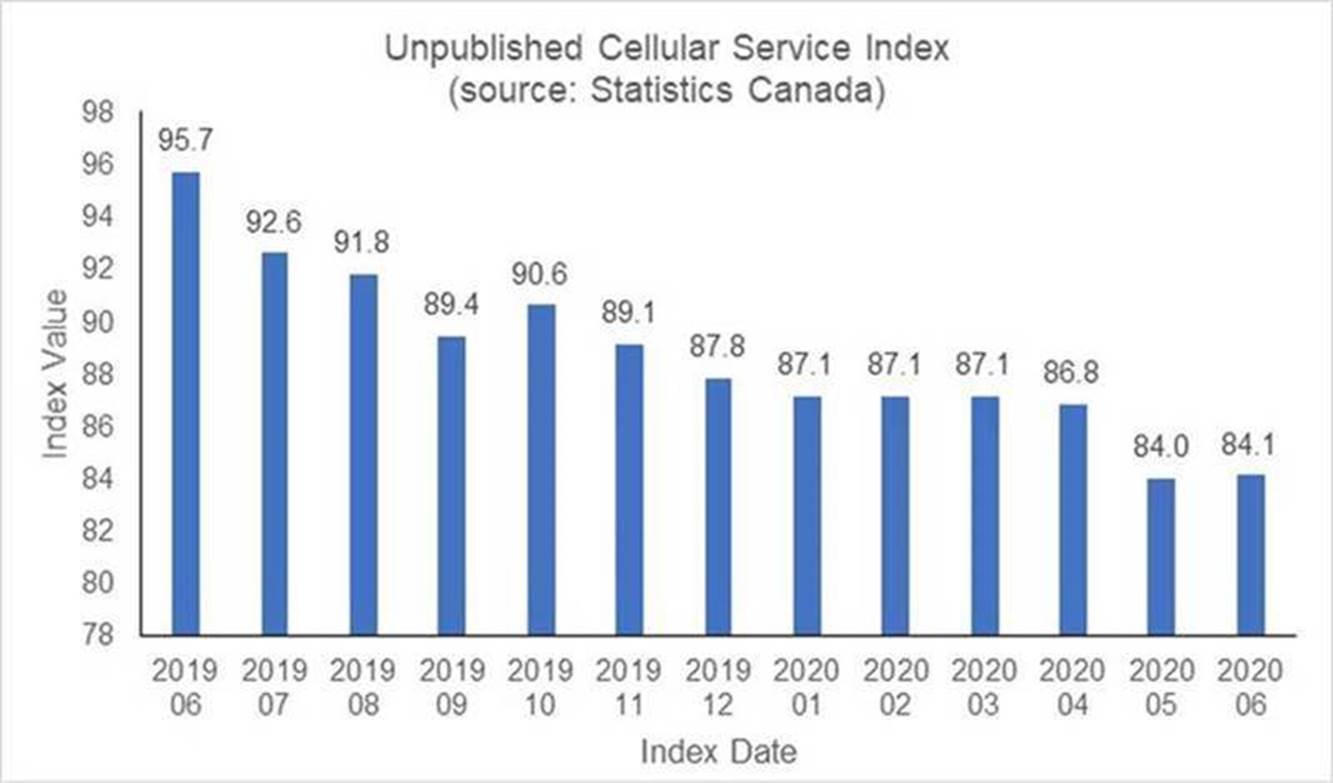

What about the industry as a whole? The Statistics Canada Cellular Index (CSI) shows industry pricing continues to drop, falling 12% between June 2019 and June 2020.

The CSI is a monthly unpublished index currently available upon request, which measures the rate of price change for cellular services purchased by Canadian consumers. A more a comprehensive and representative measure than simple price studies, the CSI compares the cost of a fixed basket of goods and services (i.e., Cellular Services) purchased by Canadian consumers in a month. Since the basket contains commodities and services of unchanging or equivalent quantity and quality, the index reflects the price consumers actually pay.

The CSI clearly shows that the price of cellular plans has decreased over the past year. In fact, half of the federal Government target of a 25% drop in wireless prices has been achieved in the last 12 months.

Why does this matter to Canadians?

Policy decisions must be rooted in fact. And simply repeating an opinion – as we sometimes see with the narrative around Canada’s wireless prices — does not make it a fact. These decisions can have far reaching and negative consequences for Canadians, as would be the case should the regulator decide to introduce mandated access at low cost to Mobile Virtual Network Operators (MVNOs) who do not invest in networks.

Facilities-based service providers have invested more than $70 billion in building wireless networks that are among the fastest and most widely available in the world, with LTE coverage reaching 99% of the population. As result of a competitive environment with continuous robust investment, prices continue to fall, while Canadians receive more value. As Canada recovers from the COVID-19 pandemic, it is vital to encourage those that will invest in the next generation of wireless technology – the facilities-based providers.

If you consider the facts on wireless pricing, it’s clear policy makers must take a number of factors into account – increased data use, the availability of bigger and unlimited plans that offer more value, and the need for continued investment and expansion to more communities across the country. The long-standing policy of encouraging competitive markets is working. It’s driving wireless prices down, increasing value for Canadian consumers and delivering a world class network experience.

Ted Woodhead is Senior Vice President, Regulatory, Rogers

[1] Excluding roaming revenues

[2] Excluding other carriers’ roaming on our network

[3] Rogers Q2 2020 results